香港熱門高息股:房地產信託基金(REITs),在2022年同大市一樣命運以跌市收場😫,過半數仲跌得傷過大市,靠這類高息股賺取被動收入嘅小股民,算係賺咗股息都彌補不了股價勁蝕的損失。究竟2023年情況能能否改善呢?

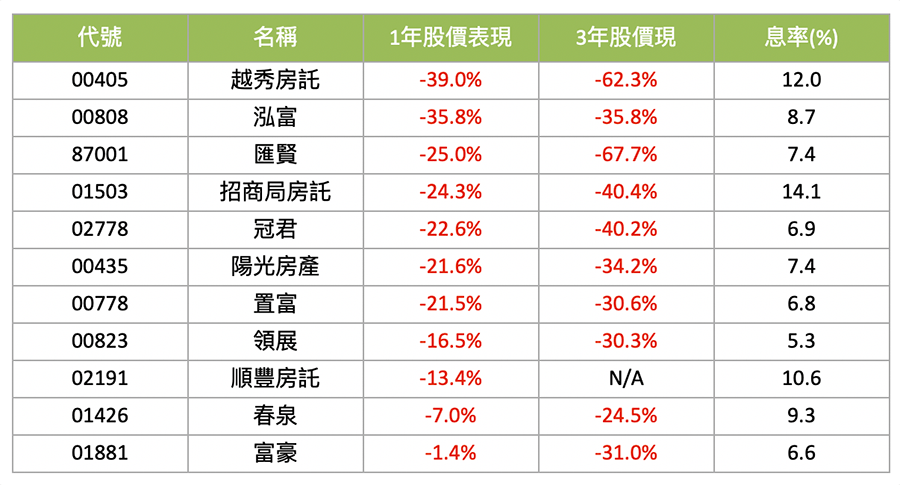

恒生指數2022年全年跌15%,11隻香港上市嘅REITs,七成跑輸大市,當中7隻跌幅超過兩成,最多仲縮水接近四成。 事實上近呢幾年投資香港的REITs,成績都不算太理想,去年情況更差。

2022年對於股市以及REITs來說,可以說是一個頗為複雜的一年,一來歐美經濟受到高通脹的打擊,同時為遏抑通脹,各地政府不惜一切調高息口,令到經濟表現雪上加霜。香港方面,情況更差,除了受到歐美經濟及加息潮影響, 內地經濟表現不似預期,政策又好多估佢唔到,加上嚴格的防疫措施,打擊了中港兩地的經濟及股份表現。

圖:REITS 2022年表現

REITs 的主要收入來自租金,經濟差、商業活動減少,店舖執笠潮湧現,執下一間又一間,租金及出租率如何保持理想呢? 加上息口上升,借錢的成本增加,在這些情況之下,香港的地產股、收租股,以及REITs都無運行。

越秀房產四面楚歌

個別股份表現方面,內地的越秀房產(0405)是一眾房產基金中,跌得最傷的一隻,跌了39%。內地經濟房地產市場出問題,以及人民幣滙價跌,進一步影響這隻基金的表現,主要收入來源的廣州白馬大廈,租金收入下降 逾一半。收入大減,基金的派息自然縮水。

領展減派息 多年首次

至於本地的REITs,龍頭藍籌基金領展(0823),成績一樣差,跌幅超過一成半,跑輸大市,近三年來累積的跌幅都有三成,呢幾年投資領展,賺埋的股息彌補唔到股值縮水的損失。

領展近多年來不斷變身,早年防守性比較高,主要收入靠與民生息息相關的街市、商場等的租金。後來這些資產陸續賣了出去,轉移採取更進取的投資策略,收購海外物業作出租用途,又在本地跟發展商聯手發展物業,這樣的情況下,遇上經濟差,它的防守性比以前減弱了,而隨著香港及內地經濟放緩, 加上息口上升,領展受到的影響,比以前明顯,所以近年股價表現令到不少的小股民失望。

領展這一隻收租股,一向以來都堅持每年都有穩定的派息增長,不過近期派發的中期式縮了水,預期全年派息也有減少的機會,股價進一步受壓。

置富拓展海外是好還是壞?

置富產業(02778)一向有以前領展的身影,收入靠私人屋苑的商場,香港經濟弱置富的出租率及租金都受影響,所以近年派息持續減少。去年基金收購新加坡的高文之星物業,同時又計劃繼續向外發展,REITs的海外投資有限制,但收購令到加息潮下,債務上升成本也上升。

冠君產業受加息影響大

擁有較優質資產的冠君產業(0778),2021年的表現相對穩定,但踏入2022年情況逆轉了,亦都同樣受到借貸成本上升及經濟不景影響。不少大型國際企業相繼遷離香港,又不知何日再歸來,令到物業出租及租金都會受到影響。不過隨着香港放寬了疫情的管控,加上中港兩地通關,令到近月以來,股價反彈唔少,但長期來說,這一個反彈趨勢會否持之以恆?是值得商榷。

富豪酒店去年跌得最少

富豪酒店(1881)在之前嚴格的防寬疫管制下,入境香港要住隔離酒店,為富豪酒店帶來一定收入,而近期香港放寬對外的入境措施,有利酒店業,這隻基金2022年表現相對冇咁差。但長線它不是我杯茶。

REITs未來表現仲睇唔睇好?

驟眼看來,香港上市的REITs派息非常吸引, 大部份都有6%或以上,原因好簡單這類股份特色就係賺幾派幾多錢,將淨賺的資金大部份用作派息,不過,在股價跌至谷底下,息率高只不過是一個表面的現象。

事實上在加息潮下,負債較多的地產公司首當其衝,加上經濟能否有所好轉也是未知數。在高息環境下,安全系數較高的長債,都有四、五厘之高,令REITs這類的高息股吸引力大跌,特別是香港的經濟環境和競爭力減弱中,再否用作長線收息之選,真的要研究一下。

(9/1/2023)